Volume indicator

Trade in the direction of interest of large players − a dream of any trader.

Contents

- Features of trade volumes on Forex

- Mathematics and parameters

- How to use Volume indicator in Forex

- Strategy with use of the indicator

- Several practical notes

The indicator Volume Forex allows to evaluate a processing techniques of tick data the attention level of «active money» to this asset profitable to use an imbalance the demand/sentence.

Features of trade volumes on Forex

Trading with volume indicators in foreign exchange market − rather conditional mechanism. Forex market does not have a common information center, therefore the actual volume of transactions on a separate asset cannot be calculated. The fact that, we consider tick volume Forex today represents quantity of price tics for unit time where, actually, one tick − the fact of the change in price of an asset for one basic point. Tick volume works as the normal statistical counter and in transactions is not connected with a real amount of money in any way.

In the trade terminal Forex is available information only on the number of transactions, and − only a weighted mean value. That is 100 trade orders of 1 trade lot volume indicators Forex will consider as 100 transactions (active dynamics!), and one trade warrant of 100 lots − as the single transaction. The number of transactions can be small, and the amount of the invested money – huge, that will exert strong impact on an asset, but indicators of it will not be noticed. It is necessary only to hope that their weighted average indicators correctly reflect the general market dynamics.

Mathematics and parameters

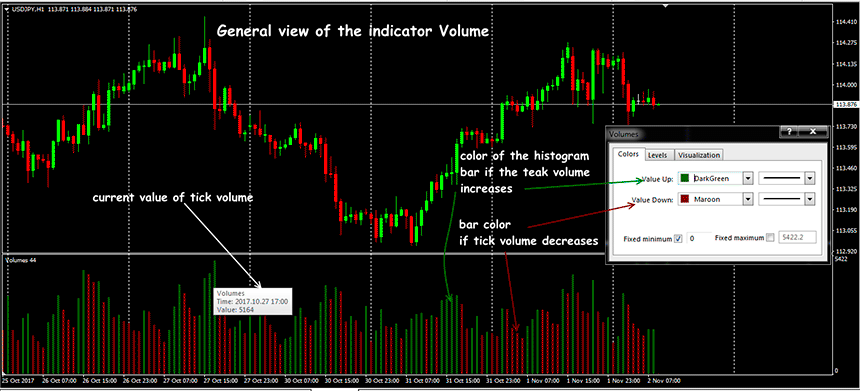

The Volume indicator in Forex has an appearance of the histogram and is located in an additional window under a price chart. The colour scheme can be configured individually, but usually select traditional: green color means that the volume of the current bar exceeds volume previous, red color − the volume of the current bar is less, than the volume of previous.

Volume value represents the number of the transactions (opened and closed) for the single period (depending on the selected timeframe). Height of a column of the histogram of the indicator is proportional to the tick volume of the market. We will remind: if you in the terminal Forex select analogues of exchange trade assets in the form of CFD (indexes, raw futures, metals) − the Volume indicator Forex will show all the same tick volumes, but not real exchange!

For exchange − traded assets − of course, when accessing relevant information − the Volume indicator will analyze volume (but not quantity!) really traded contracts.

How to use Volume indicator in Forex

The Volume indicator in trading does not give clear signals: to make a trading decision, the comparative dynamics of the histogram of the indicator and the price chart is used.

There are several standard options.

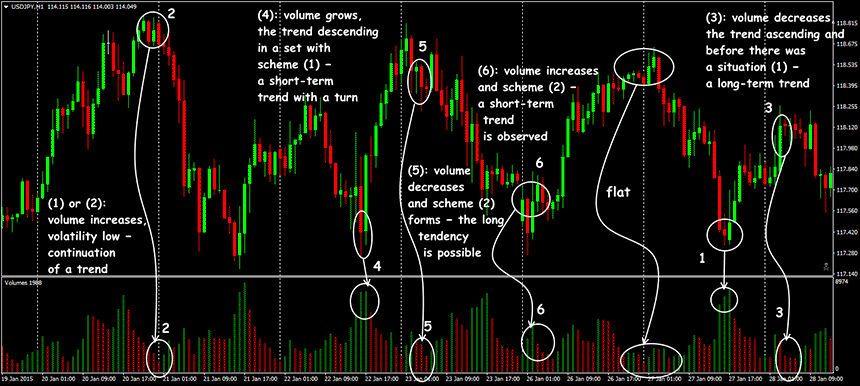

- If the value of the indicator grows on the active price movement, this means that the participants actively support the current direction and add new volumes (and money!) to it. We enter the market only in the direction of the main trend.

- The price grows, but volume decreases: demand for this asset decreases that can be a signal of a turn of the market or transition in flat. Reduction of amplitude of the histogram of the trading volume indicator means decrease of the activity − participants of the market doubt continuation of the current trend, fix results and do not open new positions.

- If the price moves on average range, but without a clear direction and volume at the same time decreases, then in the market there is an uncertainty, it becomes unpredictable.

- Growth of volume at breakdown of strong price level is a confirmatory factor of truth of a signal. The reverse situation speaks about a possible false signal.

- As a rule, a minimum volume characterizes the points corresponding to the end of the correction in the case of an uptrend. The points corresponding to local maxima must have a maximum volume. In a downtrend, volumes grow at decrease in quotations, on rollback up volumes decrease.

How to use volume indicator if it shows a serious volume with minimal price dynamics? There are two possible situations:

- In the market there are no large players, and data of the indicator are created by a lump of transactions with small volume − their efforts insufficiently for the strong movement of the price. We do not open new transactions.

- Volumes of transactions rather large, but they are open diversely − there is a fight bulls/bears and the winner was not defined yet. If your transactions are not involved in this war − new we do not open

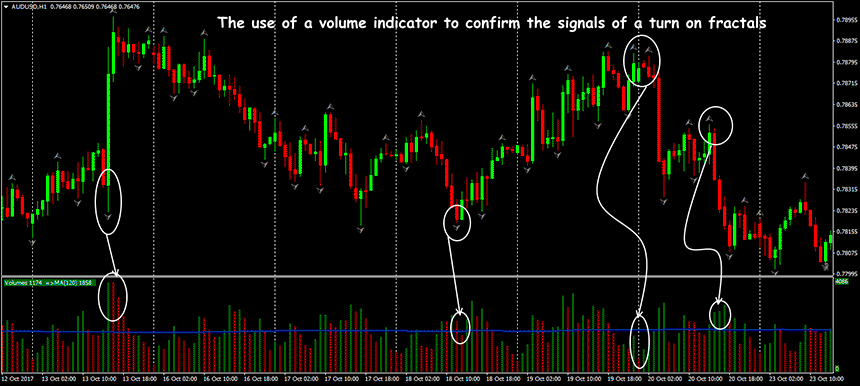

Strong trading signal of the reversal is traditionally considered as the situation of divergence of the indicator histogram and price chart.

Strategy with use of the indicator

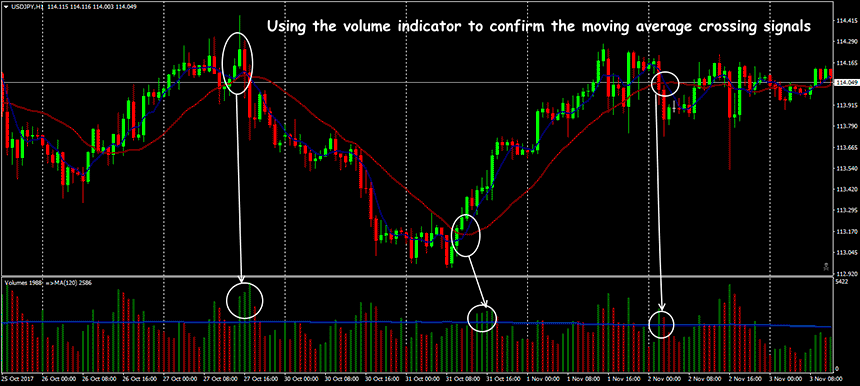

The Forex trading volume indicator of has to evaluate correctly relative volume in dynamics: average, high or low in comparison with the previous bars. In order that the price moved on one tick, it is necessary to sell or purchase a certain number of contracts, as means adding «new money» in the market. Therefore, by the sizes of tick volume it is quite possible to judge dynamics of actual volumes.

Volume trading indicators can be used in any strategy, but only for confirmation of signals. To make trading decisions only on the basis of their information − it is impossible.

Several practical notes

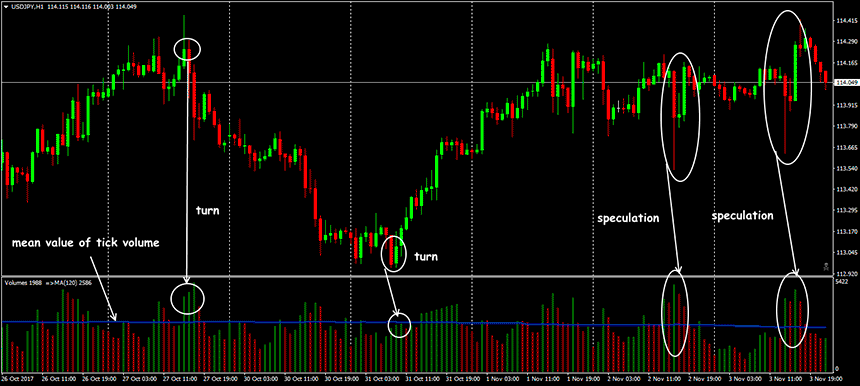

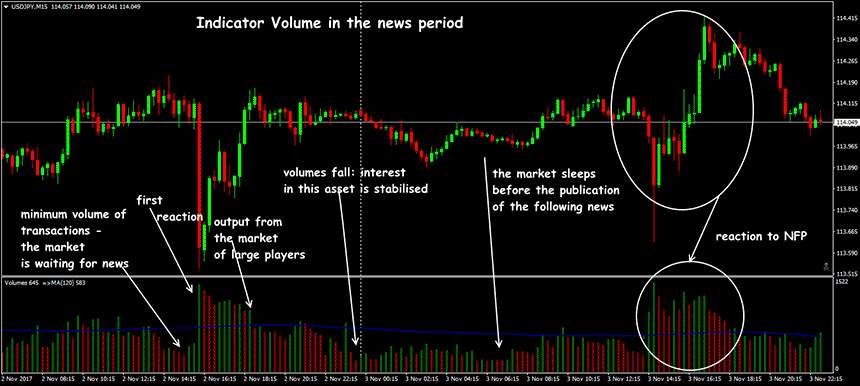

The Volume indicator usually advances dynamics of the price. When the price at first actively moves on increase in volume, but at some point volume begins to decrease, still some time (2-5 bars) the price will move by inertia in the former direction. In that case, it is possible to manage to record result of transactions.

Is the main lack of Forex volume indicators distortion of their indicators after sharp movements of the price. In such situations, it is necessary to wait until speculative volumes stop influencing the price, and the market itself will define the direction.

Transactions of large customers and the manipulation of market makers the volume indicator of forex processing is incorrect, for this reason its indications during the periods of the unstable market (opening/closing of trading sessions, news and other force majeure) − cannot be trusted.