Parabolic SAR indicator

The trend indicator Parabolic SAR (Stop and Reverse) was developed by J. Welles Wilder especially for the elimination of the effect of delay which is characteristic of trade systems by moving averages.

Contents

- Mathematics and parameters

- Trade indicator signals

- Strategy with use of the indicator

- Several practical notes

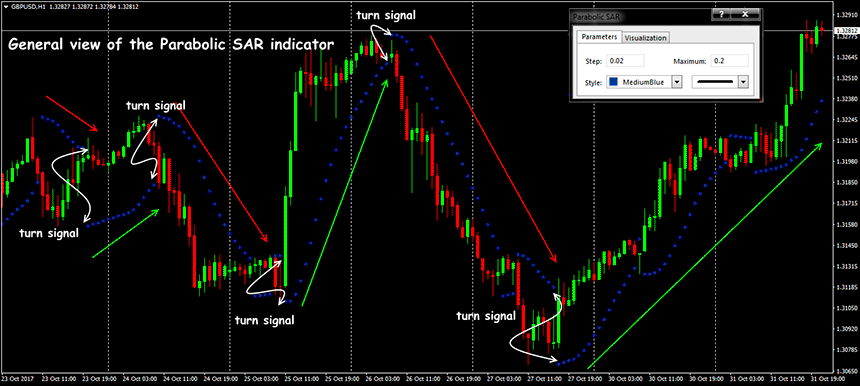

The line of the indicator moves on a trend with active acceleration and constantly changes the position concerning the price. The primal Purpose – to define the turn moment.

Mathematics and parameters

Forex Parabolic SAR indicator line is under construction on a price chart and represents a series of isolated points along the movement of the price (in a form reminds a parabola). On the ascending trend of a point of the indicator are located below a line of the prices and move after the price from below up, on descending − move from top to down above line of the price.

Calculation formula: SAR (n+1) = SAR(n) + AF * (EP – SAR (n)), where SAR (n+1) – an indicator value for 1 day ahead; SAR(n) – an indicator value of the present day; AF – an acceleration factor (by default − 0.02, or 2%); EP – value of the last extremum.

All parameters belong to a form of the line of Parabolic SAR indicator − most often standard are used. Special configuration is carried out for the big periods or assets with unstable volatility. By default the period of an indicator is equal 0.02, it isn't recommended to change him. The period is less, the more often Parabolic will show turn signals, but they will be less reliable. If to increase the Step parameter, then the line will form further from the price more slowly to react. As a result, trade signals will be less, but their reliability increases.

Trade indicator signals

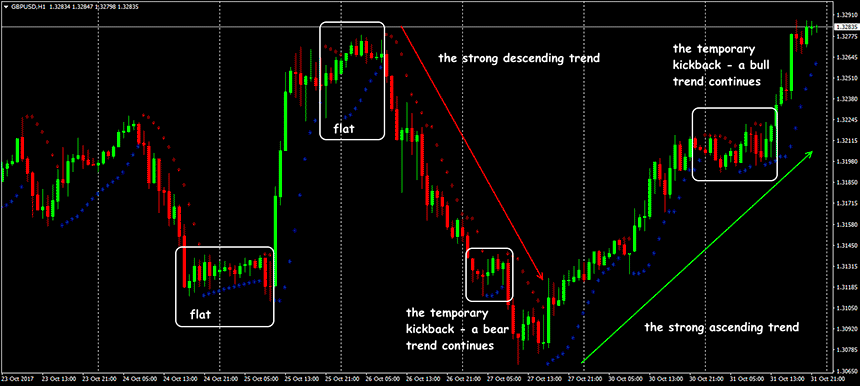

What is Parabolic SAR indicator? It is, above all, a trend, its direction, force and the moment of a turn. This technical tool always moves in the strongest direction, even if the price carries out rollback against the main trend. The main thing that range of counter motion did not exceed some maximum value. An offset value of points depends on the volatility of the price movement.

The line moves taking into account the speed of change in price − the stronger a trend, the further from price bar points more slope angle of the line appears. The slope angle − is less the market is closer to a status of a flat.

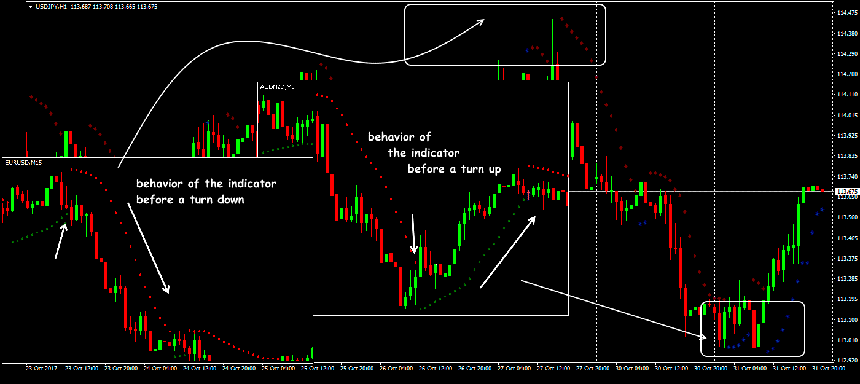

If growth is slowed down (before a turn or flat), indicator points gradually approach the price and after mutual «contact» there is «gap» − this moment and is the main trading signal: either turn or transition in flat (correction). After «gap» of the line of SAR Parabolic indicator its subsequent points move on another side from the price, max/min the price for a previous period will be the beginning of such turn.

How to use Parabolic SAR indicator in a situation of «gap»:

- emergence of a point under the price speaks about the possible growth of the price (a bull trend);

- emergence of a point over the price speaks about the beginning of downward motion (a bear trend).

An opening of positions is carried out, at least, on 2-3 bar after gap moment – points curve SAR have to confirm the emergence of a new trend.

In practice, Parabolic line turn is considered more reliable down. It is necessary to keep open for a position only in a driving direction of a line of the indicator.

Points of entry of indicator Parabolic SAR are recommended to be confirmed with additional indicators, but he perfectly shows exit points from the market. We close purchase when the price leaves below a line and sale − when rises above line of the indicator, therefore, Parabolic can be used effectively as the dynamic line of trailing-stop.

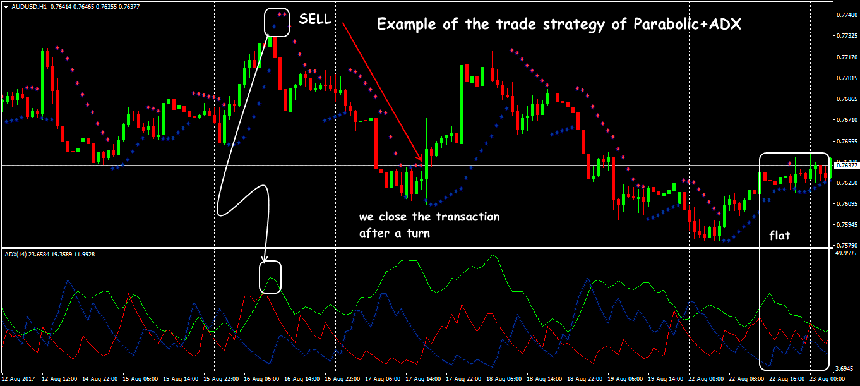

Strategy with use of the indicator

At once we will note: in trade strategy with the participation of Parabolic use of other trend indicators is not recommended. It needs to be combined with indicators of the force of a trend, volatility or classical oscillators. For example, for example, shows stable results the trading strategy Parabolic+ADX: ADX indicator evaluates «truth of a turn» and what to wait in the market: for strong movement or period of a flat. But it is worth being careful with critical ADX values: if the indicator is equal 50 (or more), then the probability of veering is high even if Parabolic SAR indicator still «does not know about it».

If ADX moves higher than level 25, then the trend is considered sufficient for careful trade, higher than level 30 -suitable for medium-term transactions. ADX usually advances emergence of points of a turn, especially on an output from a flat.

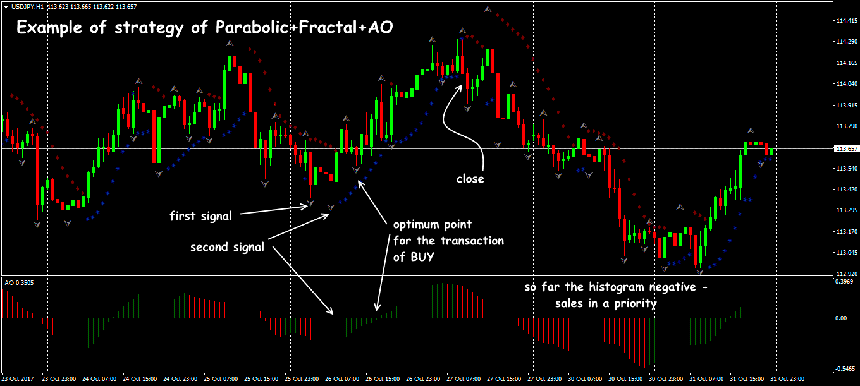

As the trend tool Parabolic SAR indicator can be effective in complex systems, for example, with Williams's indicators:

Several practical notes

A sensitivity of the indicator depends on value of a factor of acceleration (AF).

It is dangerous to open positions on a strong, long trend (long distance between Parabolic curve points) as the probability of correction or a turn is high.

Indicator Parabolic SAR value always lags behind the price, therefore in the port timing of the transaction, it is possible to set StopLoss on the level of previous «point» of the indicator (if it does not contradict a control of capital management).

If the indicator curve densely approaches a price chart – open positions it is necessary to close or record a part of the profit.

If the volatility of an asset decreases (the price «hung up» in a flat), and Parabolic SAR continues to draw points along a trend − you do not hurry to close positions. Will be to move StopLoss closer enough. An output from a flat in the direction of a former trend can be very profitable, and on a strong turn, you will manage to close the transaction on StopLoss.

Forex Parabolic SAR indicator is recommended to use for medium-term trade (period − H1 above) to avoid a negative impact of market noise.