Youre fired, Mr. Trump! America made a choice

Trump lost the battle for a second term, but this is his fault. Even if we take into account that the average American voter is indifferent to foreign policy and almost does not notice economic reforms, the country did not forgive the president for the failure of the fight against the coronavirus (230 thousand deaths) and the ricochets of the trade war with China. Public rudeness, disrespect for the voter and political rigidity led to the loss of several tens of thousands of votes in key states.

On Saturday, both candidates announced their election victories, but world leaders see the real picture − 306 electoral college votes well above the 270 victory threshold − and congratulate Biden.

Biden's victory promises the EU countries an unprecedented GDP growth on solving trade problems, introducing a digital tax on the activities of American companies in Europe, returning lost business in Iran, returning the United States to a climate agreement with forcing Britain to make concessions in Brexit negotiations.

The EU intends from the opening of the week to introduce new trade duties on US goods, implementing the WTO decision, which will mark the beginning of friendship with the new Biden administration. Greetings from the prime ministers of Britain and Israel, as well as the leaders of the OPEC countries, were more official.

Both presidential candidates have already announced their plans for the future.

Trump prepares to file lawsuits. Potentially, the results in several states could be revised, but experts are confident that the overall result will not change.

Biden said that after his inauguration on January 20, he will join the United States to the Paris Climate Agreement, reverse the United States' withdrawal from WHO, and relax laws for immigrants. Biden intends to set up a working group on coronavirus today. But so far all the aspirations of the winner are limited to executive orders, for the Democrats have not been able to gain control over the Senate.

The second round of two Senate seats in Georgia will take place on January 5, and if the Democrats win, the Senate vote will be 50-50, which, given Vice President Harris's vote, will give the Democrats an advantage. As long as the Senate Majority Leader will still remain McConnell. He has already said that the package of new fiscal stimulus should be small, as the US economy continues to recover. The lack of Democratic control over the Senate negates the chances of antitrust law with a division of FAANG companies and significantly reduces the chances of tax increases. However, there are many fiscal hawks among Republicans, so a compromise is quite possible. Probably, Biden will announce the need for more stringent quarantine measures and the democratic states will begin to change their isolation policy even before the inauguration on January 20.

Other topics − briefly:

- Fed's November accompanying statement was the same as the September text, except for minor changes in the assessment of the pace of US economic recovery. Powell continued to insist on the need for a new package of fiscal stimulus from the US Congress, not excluding the possibility of launching additional monetary stimulus, if necessary, mainly through changing the size, composition and duration of the QE program. Powell's only interesting remark was the announcement of the expansion of new economic forecasts; from December, staff forecasts and graphs of changes in forecasts of Fed members will be published.

- NFP came out confidently strong, but markets did not react as investors' attention was focused on the results of the US elections. The report is positive about the decrease in the unemployment rate, which indicates that there is no need for new incentives from the Fed.

- BoE decided to increase the QE program, the rhetoric regarding the possibility of using negative rates remained unchanged. The telephone conversation between Johnson and the head of the European Commission, Ursula von der Leyen, did not create a breakthrough, the parties acknowledged that disagreements persist, but negotiations will continue next week. Biden's victory automatically weakens Johnson's position, as Democrats have repeatedly stated that they will not ratify the US-UK trade agreement while maintaining contentious issues with the EU regarding Northern Ireland. Johnson will have to make a compromise with the EU, reaching a trade agreement between the EU and Britain will lead to the growth of the pound and, as a result, the growth of the euro. We are looking forward to at least an interim result by the EU leaders' summit on November 15.

- The demand for the Chinese currency is driven not only by the prospects for Biden's victory but also by the attractive carry trade and the rapid recovery of the Chinese economy after the coronavirus shock. The Bank of China has been fixing the yuan rate below the market for ten consecutive sessions, which may indicate the authorities' desire to suspend its growth.

- OPEC+countries outside OPEC are negotiating an extension of current oil production quotas for Q1 2021, which could lead to an increase in oil, but without the end of the second wave of the pandemic and the relaxation of quarantine measures, growth will be unsustainable. Biden's position on Iran is well known − he considers it necessary to return to the 2015 Tehran nuclear deal. This means the official return of Iran to the Iranian oil market − we are expecting comments from OPEC officials on this topic this week.

This week's calendar is not very busy, but there are statistics worthy of our attention:

- USA − consumer price inflation, job market vacancies JOLTs, weekly jobless claims, consumer sentiment survey according to Michigan;

- Eurozone − German ZEW Index, Eurozone GDP for the 2nd quarter in the second reading;

- Great Britain − labour market report, GDP statistics;

- China − inflation report;

Powell will speak at the ECB's virtual forum on Thursday, but Jay's rhetoric is not expected to change. The ECB, represented by Lagarde, will speak out several times, but the most interesting is the statement at the opening of the ECB policy review forum on Wednesday.

The beginning of this week will determine the short-term dynamics of the markets.

US assets should not be expected to be particularly positive. The dollar plans to decline due to the policy of globalization, the restoration of ties with traditional partners of the United States, the abolition of Trump's trade duties amid a growing budget deficit.

If Trump announces the filing of a lawsuit against the election result to the Supreme Court, and Biden states the need for new quarantine measures across the country, risk aversion will begin amid a rising dollar, which could last several days or even weeks.

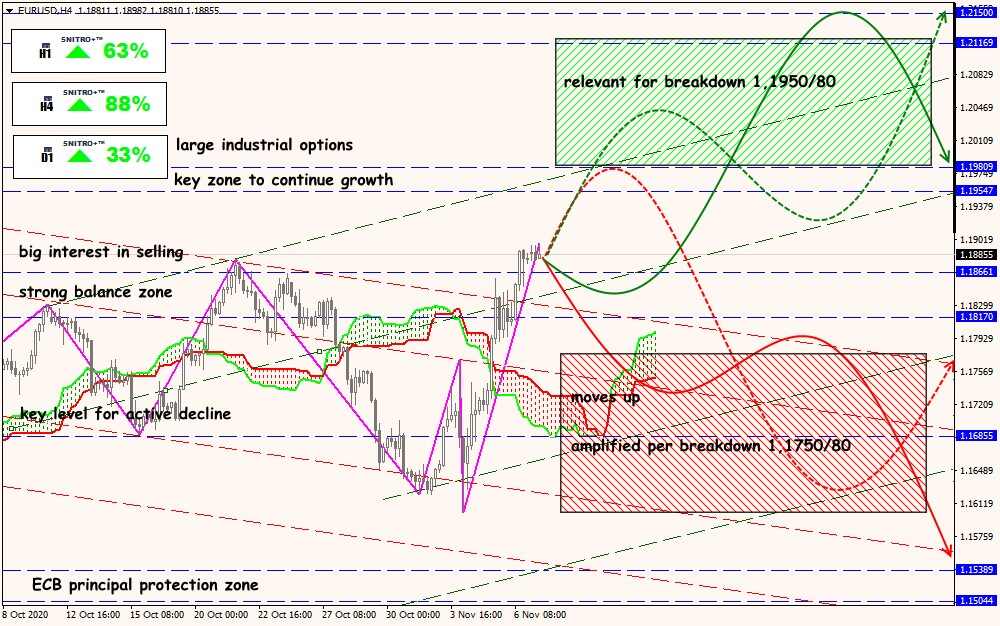

Technical Analysis of EUR/USD

Technical Analysis of GBP/USD

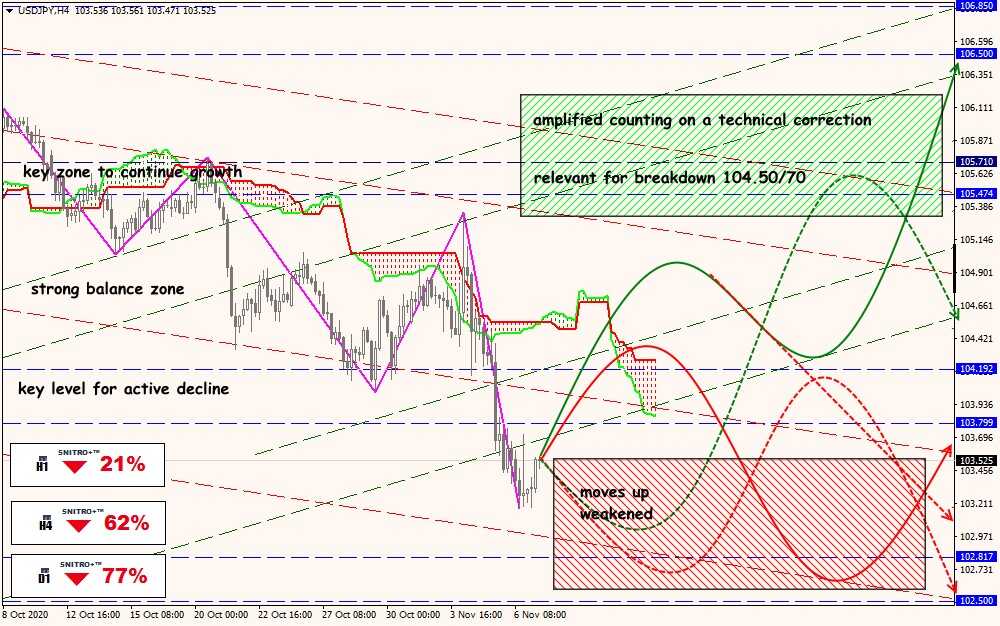

Technical Analysis of USD/JPY

Technical Analysis of XTI/USD