Contents

- Parameters and calculation procedure

- Application in trade practice

- Forex Pivot Point strategy Daily_Pivot

- Several practical notes

- Conclusion

Ability to correctly determine key points on the price chart is one of the basic conditions of the effective trading. Forex Pivot strategy is one of the simplest and effective trade techniques for the high intraday volatility markets.

Forex the Pivot Points trading Strategy at levels are applied to the technical analysis from thirtieth years of the 20th century and represent the turning points of the market allowing to build strong lines of support/resistance. Presently all calculations are automated, but it is necessary to understand that any indicators can predict turn points only for a certain temporary site.

Parameters and calculation procedure

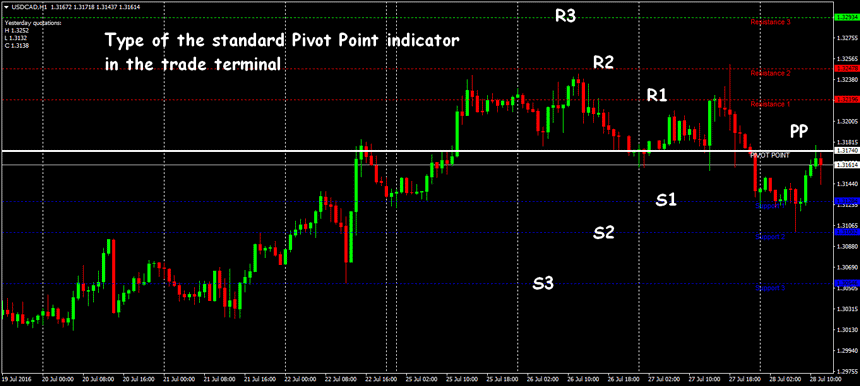

The turn price which is calculated as an average from the prices of High, Low, and Close of previous day is taken as a basis of creations. Further the standard technical indicator automatically builds three levels above/below the central line: supports (S1,S2,S3) and resistance (R1,R2,R3):

PivotPoint=(Сlose+Low+High)/3 - central line level;

S1=2PP-High; S2=P-(R1-S1); S3=Low-2*(High-PP) - supports levels;

R1=2PP-Low; R2=PP+(R1-S1); R3=High+2(PP-L) - resistance levels.

It looks:

On any Pivot Point strategy Forex recalculation of levels is carried out every day. It is meant that even in case of average trend movement at least one of them will prove.

To exclude influence of internal time of the terminal on calculations, it is necessary to use the amendment on a difference of local time with server time, for example, GMT. The main levels shall be calculated with shift of the beginning of day - it can be solved by special indicators, DailyPivot_Shift, for example, which contains the corresponding settings of time.

Application in trade practice

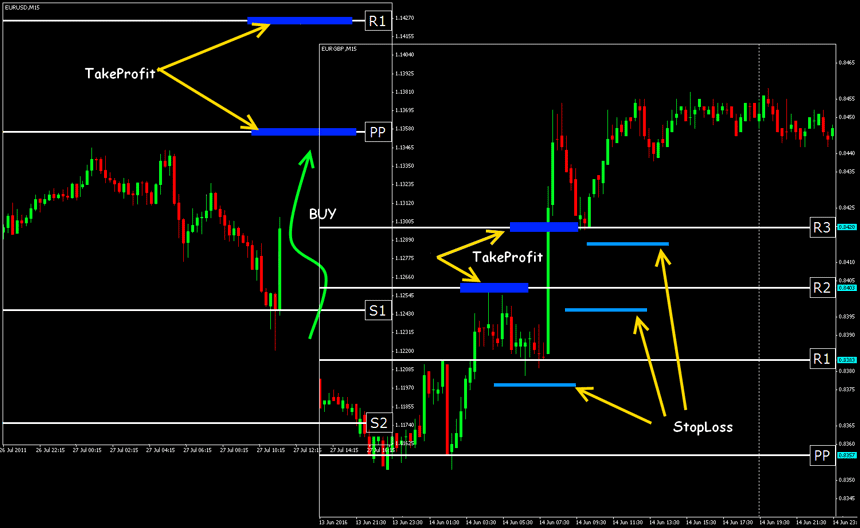

For Forex Pivot Points strategy these levels allow to identify a market situation and approximately estimate prospects, both on trend movement and during a flet (border of the horizontal channel). It is considered that so far the price moves above the central line - the trend ascending, if below - bear. In the Pivot zone the probability of a turn of the price is high, and in case of breakdown - movement at least to the following.

In Forex Pivot strategy S1 and R1 levels are considered as the most important, and other (R2, R3, S2, S3) are most often used as levels of closing of line items as in case of the price achieve by their, the market reaches a condition of an oversold or an overbuy.

On trend movement the Pivot line are used as reference points for exposure of TakeProfit/StopLoss. Theoretically the trend has to turn on the third step (S3 or R3), but even in case of strong volatility of the market the price very seldom reaches these levels. Most often the turn (or a long stop) occurs in the field of the S2-R2 levels - exactly here it is possible to fix profit partially.

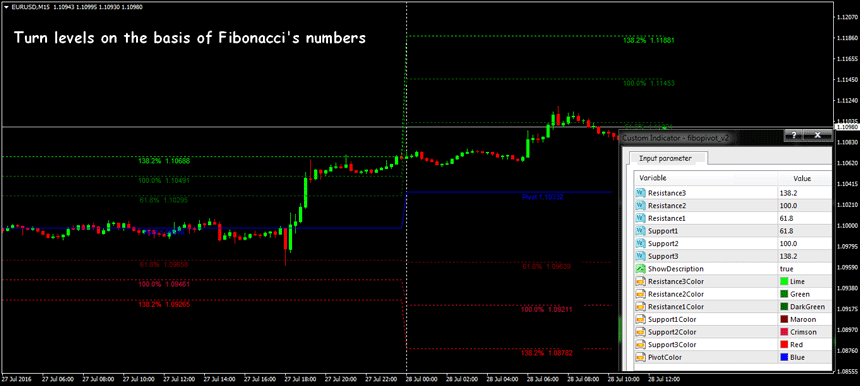

There are modifications of the Pivot Point indicator which allow to display on one schedule levels of several periods, for example, H4, D1, W1. Then, according to Pivot strategy Forex, on smaller timeframe it is possible to look for points of entry in the market, and to use levels from the older time frame as a reference point.

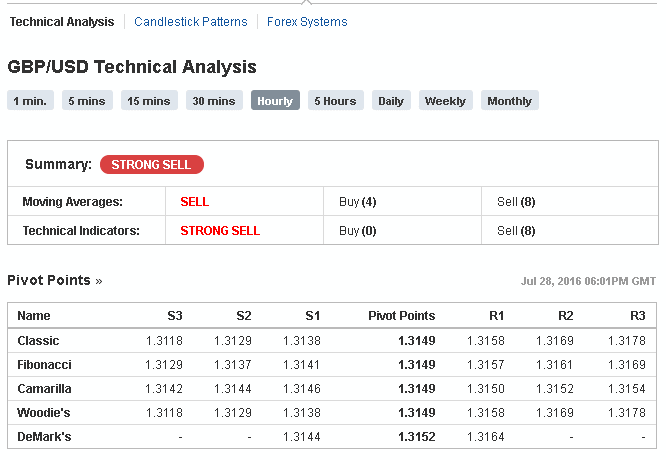

Some information resources in the block of the technical analysis offer several options of calculation of levels, but it practically does not affect efficiency of signals.

Example of such complex indicator is All_Pivot_Point which has already included all kinds of levels of Pivot - it is enough in settings of TypePivot to specify the corresponding parameters.

Forex Pivot Point strategy Daily_Pivot

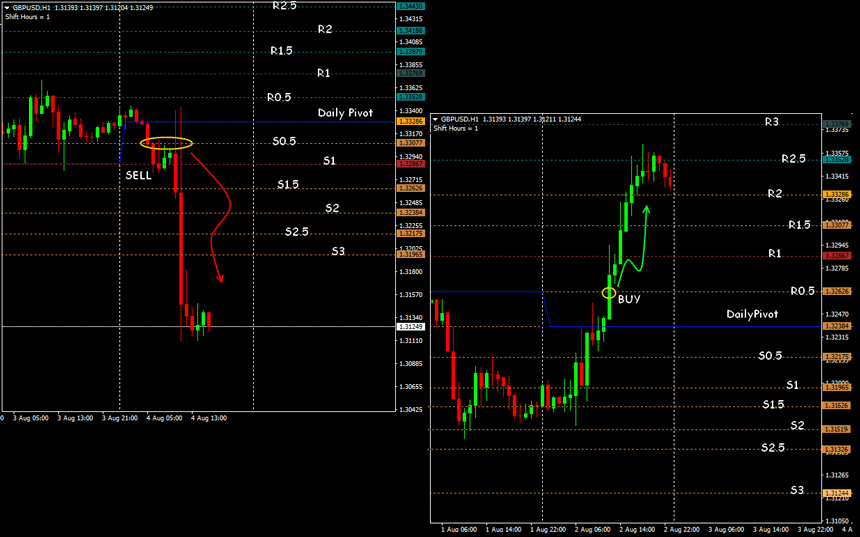

Trade asset: GBP/USD or other currency pairs with stable intraday volatility. Timeframe: H1 and above. Trading session: Europe, Europe-America. Indicator: DailyPivot_Ind2.

The indicator builds additional Pivot levels that considerably increases the accuracy of signals. The moment when the hour candle punches (or concerns) R0.5 resistance level (in case of purchase) or the level of support S0.5 (in case of sale) is the point of entry. We open the transaction, without waiting for closing of an hour candle.

In this Forex Pivot Points trading strategy TakeProfit we put on the R2 level (in case of purchase) or S2 (in case of sale), but it is recommended to use a trailing of 15-20 points. StopLoss put at the S0.5 level (in case of purchase) or R0.5 (in case of sale).

In case the price achieve the R1 level (or S1), we close 50% of amount of the transaction and transfer an open line item in the black.

It is recommended to open no more than two transactions a day on this Pivot Points Forex strategy. If after creation of pivot-levels it turns out that the price is not between the S0.5 and R0.5 levels, then it is necessary to wait until the price is included into this corridor and only after that it is possible to wait for breakdown of the S0.5 and R0.5 levels, and, respectively, to open the transaction.

Several practical notes

Traditionally for Pivot Point Forex trading strategy two options are offered - breakdown of level and trade in the range. The same level can play a role of strong resistance (there is a price release) or a support role when the price punches level, and then during correction relies on it.

Anyway, if the market has opened day above a rotation point, then it is necessary to give preference to purchases. And, on the contrary, when opening the market below the central level - we consider signals for sale.

Standard Pivot Points Forex strategy is used only one day lines therefore this technique is the most useful for intraday trade. The Pivot levels can be used as the price filter not to buy under the strong level of resistance and not to sell about support - it also actually for a scalping.

The Pivot lines can be applied as addition to trend medium-term strategy - not only for an entrance to the market, but also for maintenance of line items. If daily to update the target levels taking into account the latest events, then quality of signals will significantly increase.

Conclusion

Classical Pivot Points strategy of trading Forex are still actual, but the algorithm of calculation is not really exact because of the simplicity. Any speculative throws of the price or low volatility, for example, in the thin market, can show inadequate max/min of last day and further essentially influence on calculation of the current point of a turn. Therefore for position opening the situation of breakdown or a turn from the Pivot Points lines shall be confirmed by other indicators surely. Rather reliably the Pivot Points indicator works in a sheaf with all types of oscillators, for example, standard stochastics.