Wall Street: A New Era of Competition

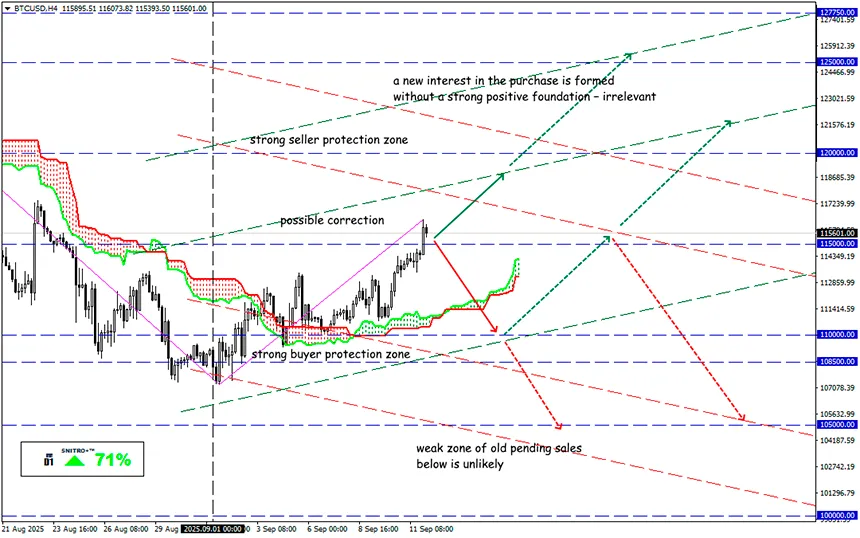

BTC/USD

Key zone: 114,000 - 117,000

Buy: 117,200 (on strong positive fundamentals); target 120,000; StopLoss 116,500

Sell: 113,500 (on a strong breakdown of 114,500 level) ; target 110,000; StopLoss 114,200

SEC Chairman Paul Atkins and Acting CFTC Chair Caroline Pham almost simultaneously announced the need for reforms.

U.S. regulators are exploring options for moving to continuous trading, legalizing new tools for cryptocurrencies, and creating super trading platforms where any operation can be performed—from buying stocks to betting on games.

Continuous trading was introduced on Wall Street 154 years ago, but since 1985 U.S. exchanges have operated only during set weekday hours. The new generation of traders no longer understands why crypto can be traded 24/7, while traditional exchanges are open for just a few hours.

Now the SEC and CFTC are ready to silence the ritual exchange bell that signals the close of trading. Otherwise, the U.S. risks losing its exchange authority. But can the market withstand round-the-clock speculative activity?

What’s needed is a platform where one can buy stocks, cryptocurrencies, oil derivatives, and simultaneously place bets on, for example, election results. Crypto exchanges have long offered all-in-one applications. However, such super software risks becoming a monopoly, through which tax authorities (and others) could gain full access to citizens’ financial transactions.

Regulators may go further by approving perpetual futures (“perpetual contracts”), which traders can keep open as long as they have sufficient margin. These contracts are already standard on Asian exchanges (Binance, OKX, Bybit). For now, such instruments are banned in the U.S., pushing American traders to offshore platforms. If rules change, U.S. exchanges could compete with Asian markets.

The new SEC and CFTC rules aim to create equal trading conditions for crypto traders and traditional players, for digital assets and classic finance. Investors gain more opportunities, crypto firms get legal competition, while banks and hedge funds will be forced to adapt.

Of course, implementing such reform could take years, but ultimately crypto players may gain an edge over traditional market participants.

Whether the U.S. remains the global exchange hub in the digital age now depends not on the amount of money, but on the determination of American regulators.

Let’s see what comes out of it.

Profits to y’all!