The market is nervous, but the FOMC remains calm

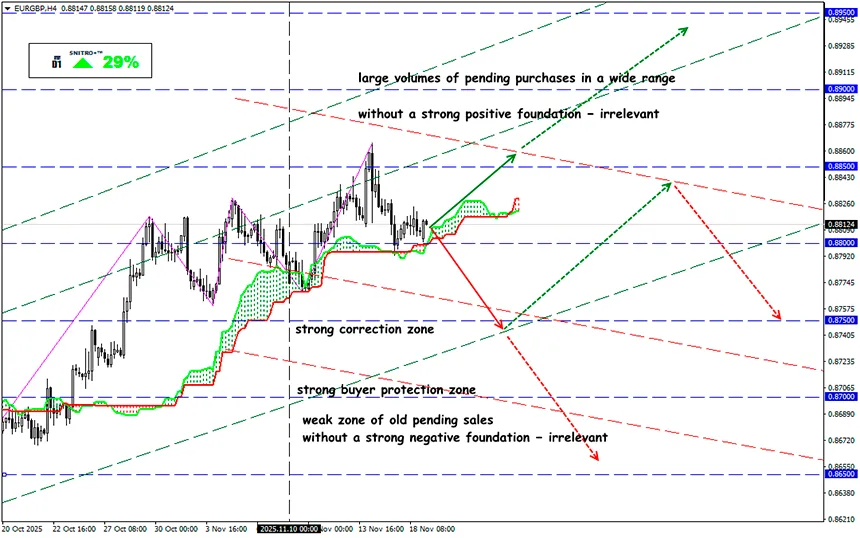

EUR/GBP

Key zone: 0.8800 - 0.8850

Buy: 0.8850 (on strong positive fundamentals) ; target 0.9000; StopLoss 0.8800

Sell: 0.8770 (on a confident breakout of the 0.8800 level) ; target 0.8650-0.8600; StopLoss 0.8820

According to recent comments, most FOMC officials lean toward keeping the interest rate unchanged in December. It is still difficult to understand on what data this opinion is based.

Recall: the final FOMC meeting of this year is scheduled for December 10, and Powell repeats at every speech that the decision will be made solely on the basis of economic information.

It is logical that the FOMC wants to see all reports on inflation, jobs and unemployment for September, October, and November before reaching a decision. And considering that during the “quiet period” — 10 days before the meeting — officials cannot give comments, there is very little time left for analysis.

But obtaining the full set of information is unlikely.

- Tomorrow the NFP and unemployment reports for September are expected, but they are outdated and irrelevant for the markets.

- In October, the U.S. went through a shutdown, so there may be no data for this month at all, and even if the BLS somehow prepares reports, their accuracy will be doubtful.

- The U.S. Producer Price Index (PPI) for September will be published on November 25.

- U.S. import and export price indices for September will not be released before December 3.

- The Consumer Price Index (CPI) for October will be released on December 10 and will no longer influence the Fed's decision.

We can only hope that the November NFP will be released on time in early December. Many economists continue to point to labor market weakness and do not believe in its recovery. If the labor market does not collapse in November, most FOMC members will likely refuse to cut rates in December.

Therefore, confidence in any interest rate forecasts is currently minimal.

Meanwhile, the market is seeing more active developments. For example, the recovery of EUR/GBP has stalled below 0.8820 due to the UK CPI report. Retail traders’ attempts to control risk are restraining euro bulls.

The decline in annual and core CPI indicates weakening inflationary pressure in the UK, while the positive monthly print suggests that some price pressure remains. These data may push the BOE toward a more cautious monetary stance.

UK Chancellor Reeves is considering options to protect small businesses from tax increases. The budget publication is expected on November 26; Reeves must find money for the budget while convincing the UK debt market that tax decisions will strengthen the national economy.

For the GBP to rise, the UK budget must not provoke a sharp decline in BOE rates. It is a difficult task, but most of the negative outlook is already priced in, so major speculations on GBP-related assets are unlikely for now.

So we act wisely and avoid unnecessary risks.

Profits to y’all!