Bitcoin: The Halving Is No Longer an Argument

BTC/USD

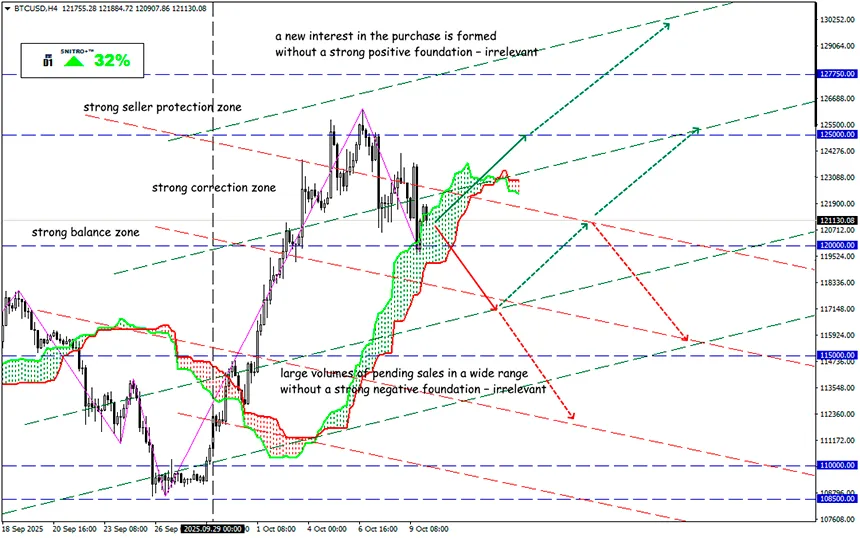

Key zone: 120,000 - 123,500

Buy: 123,500 (on strong positive fundamentals); target 127,000-127,500; StopLoss 122,700

Sell: 120,000 (on a pullback after a retest of 123,500 level) ; target 116,500-116,000; StopLoss 121,000

Traders who rely on fundamental strategies can’t understand why the usual peak models have stopped working. The classic four-year Bitcoin halving cycle has lost its power as a market driver. Today, BTC’s price depends only on global liquidity, macroeconomic indicators, and erratic politicians. Investors are seeking protection from a scandal-driven market and looking for reliable stores of value.

Just five years ago, crypto growth was synchronized with the U.S. and Chinese credit markets. Now, decisions made by financial authorities in Washington and Beijing are shaping a softer monetary environment, where the key variables are the cost and volume of money.

At present, crypto growth is supported by the fact that the Federal Reserve is cutting rates despite inflation.

China, struggling with deflation and a property crisis, is acting pragmatically — intervening in its currency whenever risks arise.

Retail players have been actively taking profits, triggering a wave of liquidations, particularly in leveraged positions. This coincided with a temporary rise in U.S. Treasury yields and a stronger dollar, which pressured broader risk assets, including cryptocurrencies.

However, regardless of what short- or mid-term charts may show — make no mistake — institutional players are betting on long-term growth. Despite price volatility, they continue to buy.

Not only private investors such as Strategy and DDC Enterprise Limited remain optimistic — Bitcoin ETFs now manage around $168 billion in assets.

Furthermore, Bitcoin has once again shown correlation with gold, which is attracting the attention of institutional investors. These flows form the basis of the current market’s stability.

Institutional demand, monetary policy support, and lower interest rates provide a solid foundation for continued growth.

In the medium term, Bitcoin remains attractive for large investors. ETF capital inflows allow analysts to forecast BTC rising to $165,000 by year-end.

For now, volatility remains low, and the market is waiting for a breakout: weekly volatility indicators are deep in the compression zone.

Remember — at any moment, $5.6 billion in short-term BTC and ETH options could trigger sudden price swings, with possible false breakouts of key levels.

So we act wisely and avoid unnecessary risks.

Profits to y’all!