The Fed Prepares a Dangerous Surprise

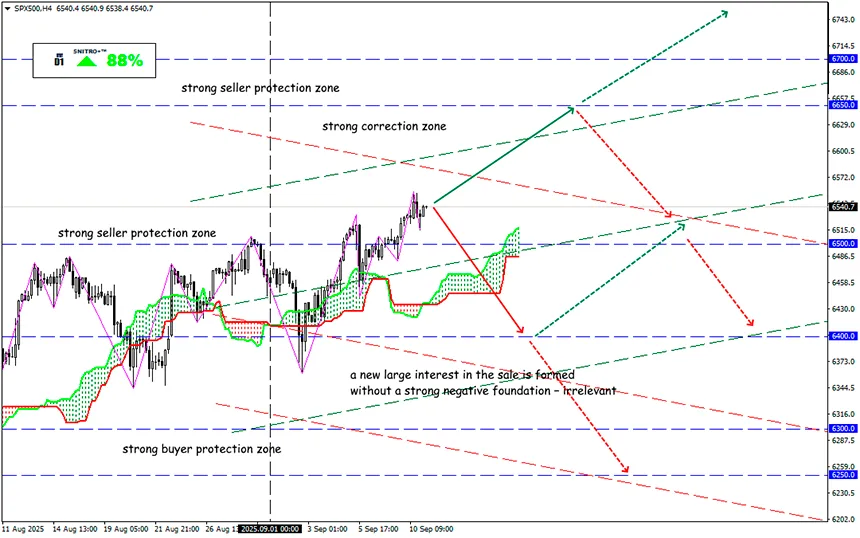

SP500

Key zone: 6,500 - 6,600

Buy: 6,580 (on strong positive fundamentals); target 6,750; StopLoss 6,500

Sell: 6,450 (after a retest of the 6,500 level); target 6,250; StopLoss 6,530

The current highs of the broad-market index reflect investor expectations shifting from “analyst forecasts” to the reality of rate cuts. Now the real issue is the scale: should the Fed opt for a cautious 0.25% move or a decisive 0.50% cut that signals economic weakness?

Yesterday, the S&P 500 and Nasdaq both closed at new record highs, driven by a sharp rally in Oracle shares and weaker inflationary pressure. A soft Producer Price Index reinforced hopes for Fed rate cuts.

Fed policy constantly balances between aggressive inflation fears and cautious corrections designed to prevent recession.

Today’s key labor market data created a powerful precedent. The downward revision of employment figures by a record 911K jobs is not a technical adjustment but a political one. This means the U.S. economy has been weakening for quite some time, hidden behind statistical illusions.

Trump’s supporters now push for a 50-basis-point cut, arguing that it would compensate for the lost opportunities of previous months. No one seems ready to consistently correct the mistakes of a strict policy.

Controversial Fed member Lisa Cook remains on the roster for the crucial September 16–17 meeting, but Trump’s attempts to change the FOMC composition show how political ambitions can interfere with monetary decisions, adding market risk.

Core CPI data will be the final argument. An expected 0.3% rise cannot prevent rate cuts, but it may limit the scale of Fed actions. Now, any positive economic indicator narrows the Fed’s room for maneuver.

“Smart money” is already shifting. Tech stocks remain resilient, dividend payers strengthen. When Treasury yields fluctuate, stable payouts look most attractive.

The market trajectory will depend not on the nominal rate cut but on the Fed’s ability to adapt to changing conditions without losing credibility. The first tradable reaction should come from the S&P 500 itself.

So we act wisely and avoid unnecessary risks.

Profits to y’all!