Successful Purchase: Silver Outperforms Gold

XAG/USD

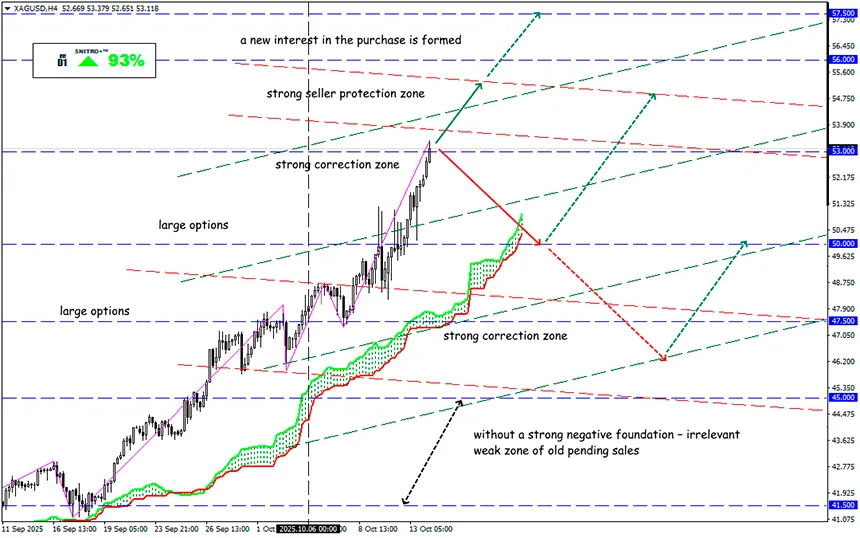

Key zone: 51.50 - 53.50

Buy: 53.30 (on a retracement to 52.00/52.50); target 55.00; StopLoss 52.70

Sell: 51.50 (on a strong negative foundation); target 49.50; StopLoss 52.20

The silver rally in 2025 has exceeded even the most optimistic forecasts. The spot price sets new records daily — since the beginning of the year, the white metal has risen by 79%, while its “older brother” has gained only +50%.

Last week, XAG/USD broke through the $50 level, and this morning it already surpassed $53. This is significantly higher than the January 1980 peak, when, due to market manipulation by the Hunt brothers, the $50 level was first tested.

Industrial demand for silver in the fields of AI, solar energy, and electronics is the key factor behind the current rally, which goes far beyond speculative interest.

After the speculative gold rally triggered by Trump’s “America Liberation Day,” traders were forced to look for more affordable assets with similar dynamics.

Investors now view silver not only as a store of value but also as a strategic commodity. Price growth is supported by strong demand, limited supply, and rising interest in real assets amid persistent inflation and volatility in financial markets.

Additionally, physical silver demand has become critical — premiums over New York futures are extremely high.

The reason is the depletion of London vaults caused by the export of metal to more profitable trading venues under Trump’s tariff policy. Since mid-2021, reserves have declined by one-third, and the main volume is now controlled by large ETFs. In other words, banks currently hold just over 200,000 ounces of “free” silver compared to 850,000 ounces in 2019. Some enterprising traders are even flying metal back from New York to Europe.

Expectations of a Fed rate cut increase the attractiveness of non-yielding assets like silver. A weak dollar and declining Treasury yields push traders to view rising precious metal prices as a means of risk redistribution in favor of tangible assets.

Analysts predict global industrial demand for silver will rise amid shrinking supply. Even the most cautious optimists now expect prices in the $80–100 range in the near future.

Market sentiment toward gold and silver remains positive, and silver-linked assets are an excellent choice for medium and small-cap speculators.

Currently, the price has entered a correction phase, but buyers need to keep it within the $50–52.50 range. Another confident breakout above $52 will attract additional speculative inflows and create potential for movement toward $53.50, while failure to hold above $50.50–$49.90 could extend short-term consolidation. Volatility remains high — risk control must be strict.

So we act wisely and avoid unnecessary risks.

Profits to y’all!