Powell Proves a Strong Fighter

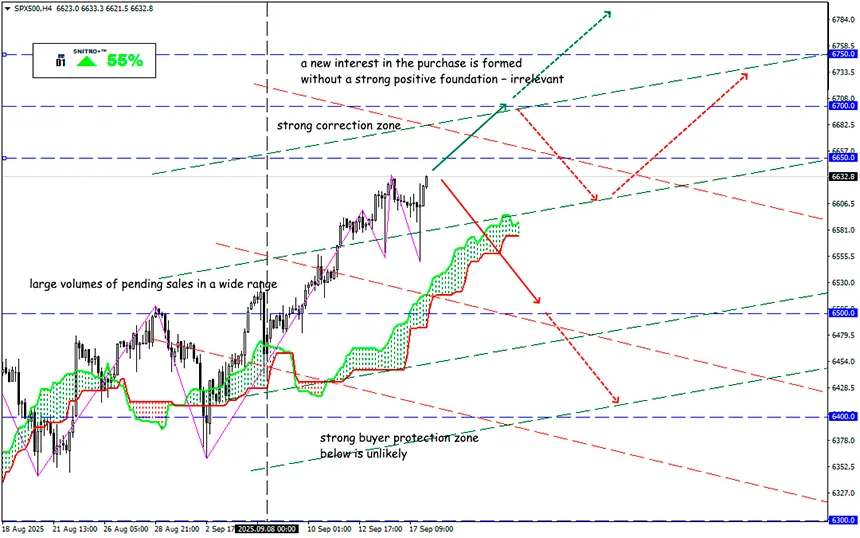

SP500

Key zone: 6,600 - 6,650

Buy: 6,700 (on strong positive fundamentals); target 6,850-6,900; StopLoss 6,620

Sell: 6,600 (on a pullback after a retest of the 6,650 level); target 6,450; StopLoss 6,680

The rate decision was firm: FOMC members showed rare unanimity – with only one dissenter, Trump’s protégé Steven Miran, voting for a 0.50% cut. The Federal Reserve stood united against Trump’s attempts to undermine the independence of the monetary regulator.

Miran’s vote can hardly be taken into account at all, since he is not even a Fed member and still hasn’t resigned from his previous White House post.

How Jay managed, under Trump’s relentless pressure, to bring together Fed members – including the president’s appointees Waller and Bowman – remains unclear, but in any case, it was a politically skillful move worthy of respect.

No commitments were made regarding further cuts, either in the accompanying statement or in Powell’s responses during the press conference.

In brief, Powell stated:

- Unemployment remains low despite weak growth.

- Job growth is slowing, and risks of job losses are rising.

- GDP decline reflects weaker consumer spending.

- Arguments in favor of persistent inflation are fading, while labor market risks are increasing, narrowing the Fed’s dual mandate.

- The shift in the risk balance was widely acknowledged by Fed members, and the institution is fully capable of responding effectively and in time.

- The Fed will make decisions on a meeting-by-meeting basis.

Powell openly blamed Trump’s immigration policy for slowing the labor market and driving goods inflation higher (1.2% since the beginning of the year). He also backed BLS revisions to employment data.

Effectively, Powell is signaling the risk of recession, yet not offering direct financial aid to the economy, only gradual rate cuts toward a neutral level. And the one responsible for that recession risk – is Trump himself.

Jay refused to answer whether he would step down from the Fed after his term as Chair ends, which adds further headaches for Trump. Reminder: Powell has the right to remain on the Fed Board of Governors after May 2026, meaning Trump would lose a seat.

The market’s initial reaction spooked investors, as it lacked real justification. The decision was expected, so although the response was volatile, equities ultimately went nowhere. The U.S. dollar first dropped but then slightly recovered – the classic “sell the rumor, buy the fact” playbook.

By morning, however, the Fed’s softer tone finally reached the market, with stock index futures rising 0.3–0.7%. Still, this is not critical, and the medium-term trend remains intact.

So we act wisely and avoid unnecessary risks.

Profits to y’all!