Political flash crash: collapse or chance for profit?

EUR/USD

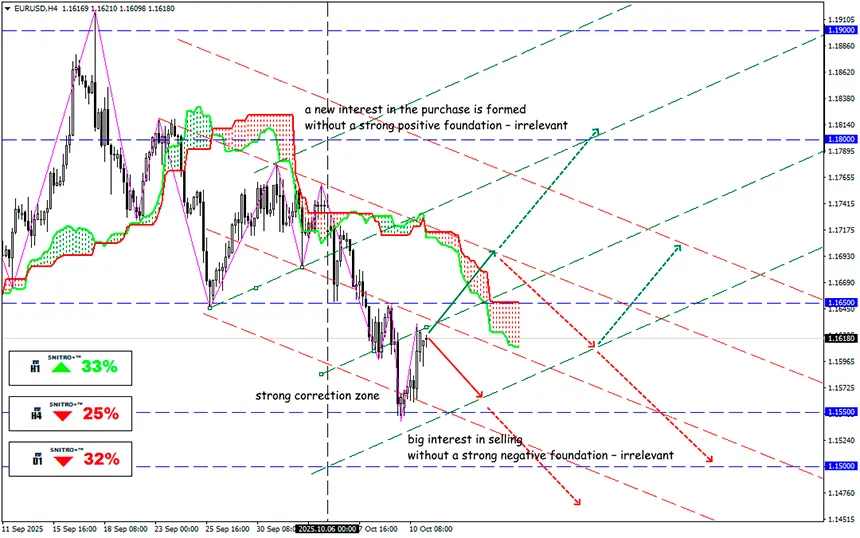

Key zone: 1.1550 - 1.1620

Buy: 1.1650 (on a strong positive foundation) ; target 1.1800-1.1850; StopLoss 1.1580

Sell: 1.1550 (after the 1.16 retest) ; target 1.1400-1.1350; StopLoss 1.1620

On October 10-11, the critically overbought financial market, which had not seen a full correction for several months, panicked and removed StopLoss on both sides of the price.

It is unlikely that anyone managed to make a full profit on this fall — trading terminals did not respond, and neither TakeProfit nor StopLoss worked. There will be mass complaints against brokers, but they will be essentially useless — such force majeure situations are clearly stated in the trading rules.

The stock market and cryptocurrencies collapsed after the US reacted to China's tightening of export controls on rare earth metals. Trump, upset by his failure to win the Nobel Prize, threatened to raise tariffs on all Chinese goods by 100% from November 1, to refuse to meet with Xi Jinping at the APEC summit on October 30-November 1, and other unpleasantries.

Seeing the market reaction, Trump announced a few hours later that he had not yet decided whether he would actually be so categorical, but it was too late. Donnie tried once again to save the situation before the markets opened on Monday, stating that the US did not want to harm China and that there was still time to reach an agreement before November 1. Alas, Beijing's response was very harsh, with no willingness to compromise.

In response, the surviving cryptocurrencies rose, the stock markets also corrected, and today this dynamic will continue, as on Columbus Day, with the US debt market closed, the stock market usually rises.

In a situation where NATO needs a lot of weapons and the EU is rebuilding its industry through the defense sector, China's restriction on RBM supplies is an extremely important factor. Germany, which has bet on the military industry but has less opportunity to purchase RBM than the US, will be worst affected in this situation.

Nevertheless, the panic on the US market was much stronger.

The crypto market plummeted after the stock exchanges closed on the night of October 11, with the main phase of liquidations taking place within 10-15 minutes. Crypto lost almost 22.5% of its turnover, something similar, but on a smaller scale, happened on November 9, 2022, and May 19, 2021.

Excluding capitalized cryptocurrencies that are bought back by large capital and monetary reserves (BTC, ETH, BNB, SOL, TRX), the defeat was total: XRP (57%), AVAX (-70%), LINK (-65%), LTC (-60%), ADA (-66%), DOT (-77%), and TON was destroyed by 80%. The volume of liquidations amounted to about $20 billion in futures, of which $16.7 billion was in purchases.

Over 99% of margin crypto accounts on the market in the altcoin and scamcoin group were completely liquidated.

Note how the major currencies reacted: Europe showed a slight gain, while Asian currencies reacted speculatively only in the most liquid crosses (e.g., AUD/JPY, EUR/AUD, GBP/JPY). All stock indices were the most nervous, but a 50-70% correction has already taken place.

Conclusion:

It doesn't matter what you prefer — stocks, currencies, crypto, options, debt securities — you cannot trade:

- without understanding the technical characteristics of the asset on which you are opening a trade;

- without up-to-date analysis of fundamental factors and news;

- without analyzing intermarket relationships and the mutual influence of assets;

- without reasonable leverage;

- without strict money management, StopLoss, and risk hedging with additional assets;

Also, do not keep more than 20-30% of your capital in open trades.

Remember: the financial market existed before us and will continue to trade after us, but whether we participate in this process is up to each of us to decide.

So we act wisely and avoid unnecessary risks.

Profits to y’all!