How Political Chaos Kills the Economy

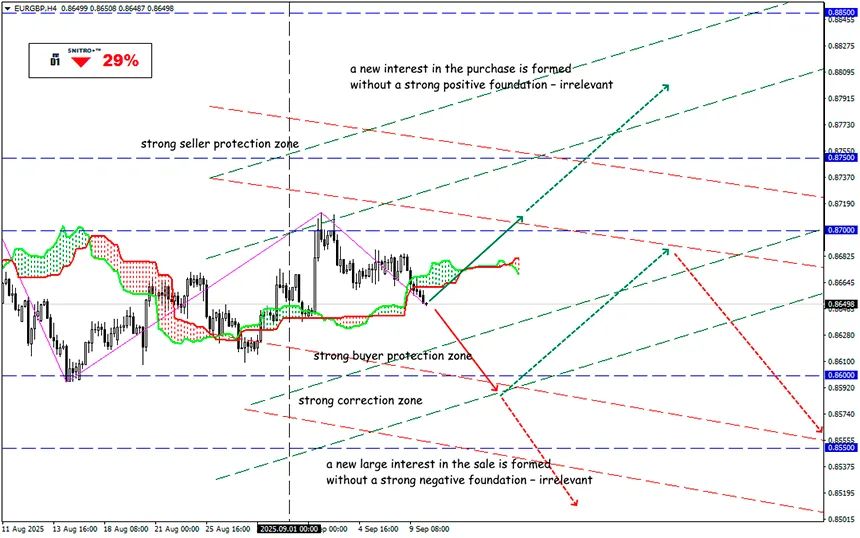

#EURGBP

Key zone: 0.8620 - 0.8680

Buy: 0.8700 (after a solid breakdown of 0.8680); target 0.8850; StopLoss 0.8630

Sell: 0.8600 (on strong negative fundamentals) ; target 0.8450; StopLoss 0.8670

The opposition has forced yet another prime minister to resign — the centrist François Bayrou — over his plans to cut the budget by €44 billion ($52 billion). The prolonged government crisis is holding back business activity and consumer spending. Paris is now seen by the market as part of the eurozone’s periphery with elevated risk.

France no longer has even a virtual scenario for escaping the crisis. The new government, which must present a “more efficient” budget plan for 2026 by October 7, will clearly be less ambitious.

France is drowning in debt: in June, public debt reached €3.3 trillion, equal to 114% of GDP. This figure is lower than Greece’s (153%) and Italy’s (138%), but unlike them, Paris does not have a meaningful budget surplus. The Court of Auditors has warned that debt servicing could exceed €100 billion by 2029 if growth slows or deficit-reduction measures fail. In 2024, debt payments totaled €59 billion, making them the single largest budget expense.

President Macron has no plans for early parliamentary elections, believing them to be politically useless and too costly for the budget. Sébastien Lecornu, the former defense minister whom Macron appointed as the new prime minister, said he would focus on restoring political stability.

Meanwhile, today France faces a nationwide strike under the slogan “Block Everything,” announced by unions earlier this summer.

Financial markets are already reacting negatively, especially to the prospect of higher taxes and slowing growth, which has also raised concerns in the UK.

French bonds have long been considered among Europe’s safest assets. But amid the political deadlock, Paris is being forced to pay a higher risk premium. The yield on 10-year French bonds has already risen to 3.47–3.49%, higher than that of Greece and Italy.

French instability will weigh on the euro, though the effect may remain limited. The correlation between French sovereign risk and the euro is usually weak, with reactions likely only under extreme stress. So far, the pressure is visible only on banking stocks: shares of BNP Paribas, Crédit Agricole, and Société Générale are down 8–10%.

Despite the chaos, the euro shows moderate strength against the U.S. dollar and may even keep an upward trend in the short term. Overall, French risks are already priced in: the expected hit is limited to 0.5–0.75% and is likely temporary. However, technical resistance levels — 1.1800 in EUR/USD and 0.8700 in EUR/GBP — could cap further gains.

So we act wisely and avoid unnecessary risks.

Profits to y’all!