Metal or Stocks: Which Gold Is More Profitable?

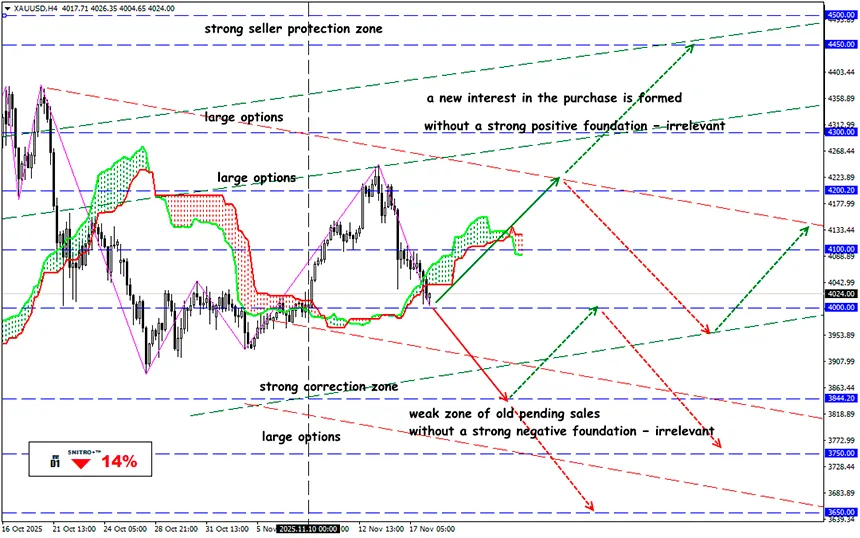

XAU/USD

Key zone: 4,000.00-4,100.00

Buy: 4,150.00(on strong positive fundamentals); target 4,300 -4,350; StopLoss 4,080.00

Sell: 3,950.00(after retesting the 4.100 level); target 3,800-3,750; StopLoss 4,020.00

Gold investors have not seen a more favorable market in decades. The third quarter of 2025 feels like the beginning of a new era for the yellow metal.

According to the WGC, global demand in Q3 reached 1,313 metric tons — an all-time record. In dollar terms, the world spent $146 billion on gold, with an average price of $3,456 per troy ounce — 40% higher than a year earlier.

In October, gold surpassed $4,400 for the first time in history, and even after a technical correction it continues trading above $4,100.

Investors have also been pouring money into gold ETFs at the fastest pace since 2020; demand for bars and coins remained above 300 tons for the fourth consecutive quarter.

However, the market suggests that mining companies outperform physical gold in terms of returns.

Below are several companies whose shares are traditionally held by large hedge funds and private investors — and are rarely sold in any market conditions. All data as of September 30.

• Barrick Gold

+207% in Q3

Ticker (NYSE: GOLD) or (TSE: ABX)

The company is considering relocating from Toronto to the U.S. and is demonstrating a successful turnaround. After years of lagging behind competitors, Barrick refocused on core operations, sold non-core assets, and made free cash flow growth and balance sheet strength its top priorities.

• McFarlane Lake Mining

+341% in Q3

Ticker: MLM (CSE/NEO), MLMLF (OTC US)

McFarlane has decades of experience building mines in Ontario. The company is developing the Juby Gold project in the Abitibi Greenstone Belt — a region that has produced more than 200 million ounces of gold over the past century. In September, McFarlane updated its resource estimate to about 1 million ounces; adjacent properties, including the McMillan holdings, offer significant upside potential.

• Omai Gold Mines

+650% over 12 months

Ticker: OMG (TSXV), OMGGF (OTCQB)

The company posted exceptional annual growth thanks to the legendary Omai mine in Guyana, one of South America’s richest gold regions. The August report showed 2.1 million ounces of proven reserves and 4.4 million ounces of inferred resources at the Wenot open-pit system and the deeper high-grade Gilt Creek deposit.

Of course, supply growth in the gold mining industry is much slower: major new discoveries are rare, and the average time from discovery to production is at least seven years.

Nevertheless, conditions remain favorable for gold miners in Q4. Gold has already risen 66% this year; budget deficits are growing; geopolitical tensions are rising; and central banks continue diversifying their reserves away from the dollar.

So if you allocate 15% of your investment portfolio to gold, with 5% in physical gold and 10% in high-quality gold mining stocks, mutual funds, and ETFs, no market turbulence will be able to destroy your portfolio.

So we act wisely and avoid unnecessary risks.

Profits to y’all!