Can the Dollar’s Strength Be Trusted?

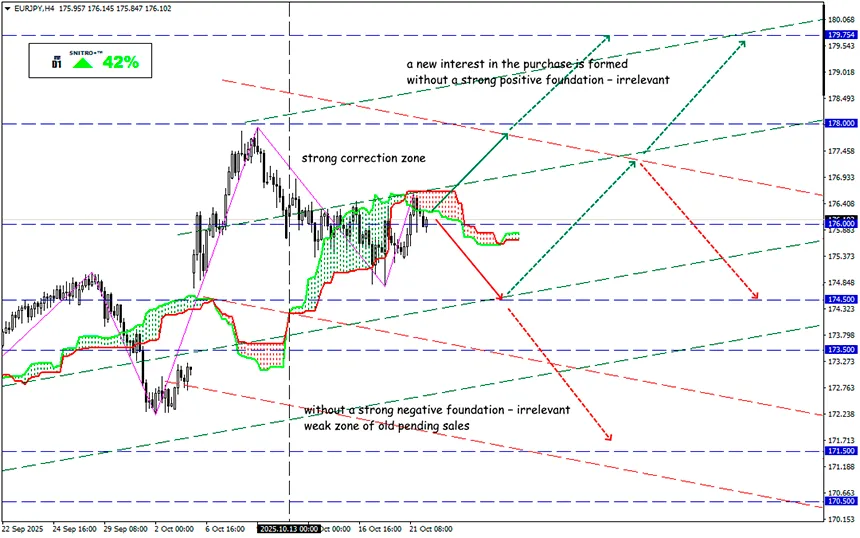

EUR/JPY

Key zone: 175.00 - 177.00

Buy: 177.00 (after retest of 176.50) ; target 178.50-180.000; StopLoss 176.30

Sell: 175.00 (on strong negative fundamentals) ; target 173.50; StopLoss 175.70

The U.S. market remains in a stable flat trend: S&P 500 futures are consolidating during premarket trading. Local currency market dynamics are still dominated by the political disputes between the United States and China.

The dollar is gaining strength despite overly optimistic expectations regarding further actions by the Federal Reserve. At the same time, over the past two weeks, we’ve repeatedly seen sharp price spikes on both sides of the market.

Yesterday, the Dow Jones Index added 0.47%, updating its historical high amid positive results from Coca-Cola and 3M. The S&P 500 ended the day unchanged, while the Nasdaq Composite fell 0.16% as momentum in the technology sector weakened.

Market participants are confident that the Fed will cut interest rates twice this year — at the October and December meetings — by a total of 50 basis points. The probability of this scenario exceeds 90%. In addition, according to the CME FedWatch Tool, the likelihood of another rate cut in January has risen to 54%.

P.S. Trump will like it. But does the market need it?

The market has become highly sensitive to comments from Powell and other Fed officials (Waller, Miran, Bowman). This is understandable: due to the ongoing government shutdown, we still don’t know the results of September’s NFP report and can only rely on ADP data, which showed a 30,000 decline in private-sector jobs.

Inflation reports in the U.S. are also delayed, except for September’s CPI, which will still be released on Friday. Wall Street expects a rise from 2.9% y/y to 3.1% y/y. If the release lands in the “red zone,” confidence will grow that the Fed will cut rates by 75 basis points over the next four months.

But the dollar’s steady strengthening looks questionable, and the main reasons for doubt — Trump and China.

Trump once again threatened to impose 100% tariffs on Chinese imports in response to China’s announced export restrictions. Both countries decided to levy additional port duties and exchanged new threats.

The escalation pressured the greenback. When Trump later softened his tone (after striking a deal with Australia on rare-earth materials), the tension snapped back, and the dollar strengthened across markets. However, this remains a very unstable argument for growth.

For now, the market sees only Trump’s solo performance. Whether Beijing will agree to accept merely the cancellation of not-yet-implemented tariffs as a compromise remains an open question.

Large investors continue to bet on the dollar: last week they bought an additional $4.0 million worth of WisdomTree Bloomberg US Dollar Bullish Fund (USDU) shares. That’s an average result, but such purchases have been recorded for four consecutive weeks. The total volume of $24.6 million is a serious signal.

At the moment, it’s worth being cautious with dollar speculation until clearer political signals emerge from both the Fed and the ECB. The performance of European currencies will depend on how regulators balance inflation risks against slowing growth, while U.S.–China trade talks add another layer of complexity.

So we act wisely and avoid unnecessary risks.

Profits to y’all!