Bitcoin vs Gold: Bets Are Placed, No More Bets

BTC/USD

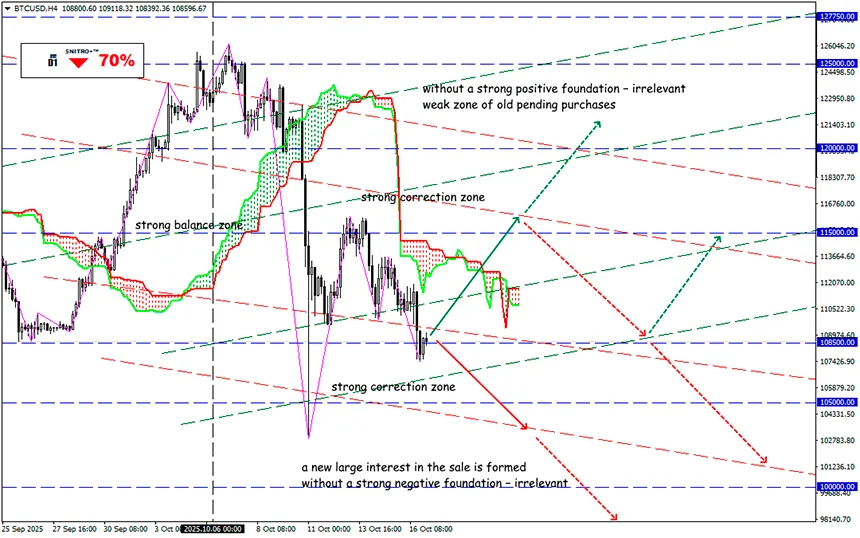

Key zone: 107,000 - 111,000

Buy: 111,500 (on a confident breakdown of the 110,000 level); target 115,000-118,000; StopLoss 110,500

Sell: 107,000 (on a pullback after a retest of the 110,000 level) ; target 105,000-103,500; StopLoss 108,000

A week has passed since the global flash crash of the financial market. Bitcoin continues to fall as sellers dominate amid a reduction in ETF inflows after breaking all protective levels, including the major options zone at $110K.

At this point, it doesn’t even matter what triggered last Friday’s crash — what’s interesting is what fueled the rebound and why crypto failed to profit from it. After markets recovered from the shock, it became clear that retail investors were the ones massively “buying the dip.” According to CBOE option exchange data, more than 110 million option contracts went through clearing — a historic record surpassing the previous 102.6 million.

Despite the panic, retail crypto investors did not exit the market; on the contrary, they increased their bullish bets. They purchased 11% more call options (on price increases) and 23% fewer put options (on price declines) than institutional players, including crypto whales. This became the largest retail capital inflow since the meme-stock mania of 2021.

The most active contracts were on the S&P 500, QQQ, and companies like Wolfspeed, IREN, and Applied Digital. As soon as small traders managed to recover at least 50–70% of their losses on a rapid rebound, these options were quickly sold off.

As a result, Bitcoin failed to build a solid financial base for a confident reversal. The main factor driving the current crypto decline remains gold.

Only in gold do panic purchases continue — today there was an attempt to test $4400. The gold market capitalization exceeded $30 trillion. In gold terms, Bitcoin has fallen 32% from its August peak.

Since gold continues to rise amid geopolitical uncertainty and strong demand from central banks, opinions are strengthening that Bitcoin has not become a reliable store of value.

Posts claiming that “Gold is eating BTC” and urging to buy “real gold” have gone viral not only among retail investors but also among traders and analysts.

There is a surge in demand for all types of gold-linked assets, including physical gold. Some central banks have even been forced to suspend sales of small bullion bars. This usually happens at the final stage of a price rally, yet no signs of a reversal in the gold bull trend have been observed so far.

Historically, Bitcoin has always recovered confidently after major corrections, but the current situation carries complicating factors.

Yesterday, the U.S. stock market saw sell-offs in the XLF sector and small-cap companies. On average, stock indices fell by 0.6%. The yield on 10-year U.S. Treasuries dropped below 4% per annum. Yet neither markets nor policymakers are ready to admit that the U.S. economy is in trouble.

All long-term BTC bull market forecasts are based on the expectation of a consistent Fed rate-cutting cycle, which should start next week. Without this, a sustained bullish trend in crypto is unlikely. Gold, in the current situation, looks far more reliable.

So we act wisely and avoid unnecessary risks.

Profits to y’all!