America in search of a new enemy

The July labour market report proved once again that you shouldn't trust any preliminary statistics. The ADP report filled the markets with pessimism, but as it turned out, the dynamics of financial instruments at the close of the week was more associated with conclusions on the general situation, including the second wave of the coronavirus pandemic in Europe and the resumption of trade wars by Trump. The NFP data turned out to be quite positive; the most important success is the reduction in the unemployment rate. The impact of the report on the market is short-term, the main pairs practically did not react.

As you know, any war (trade − too) is accompanied by a risk avoidance against the backdrop of a rising dollar, and in this situation, the second wave of coronavirus will multiply the negative impact on the global economy. The economy of the Eurozone will receive the maximum blow from a combination of trade aggression and a pandemic, but for now, the focus of attention is on the United States in the person of its hyperactive president.

Trump announced an increase in duties on Canadian aluminium and limited the use of Chinese apps TikTok and WeChat. At first, it was only known about the impending ban of TikTok; the reason is the illegal collection of information about users. The sanctions against ByteDance look like an attempt to help Microsoft, which is in talks to buy the company's US operations. But the blow to Tencent, the second largest company in China by capitalization, was a surprise to investors. The company's shares plunged nearly 10%, and the total capitalization of Chinese tech companies on the Hong Kong stock exchange fell by $75.7 billion. The news also caused the yuan to weaken.

Now Canada is waiting for the next step − an increase in duties on steel, the government's reaction has not yet been commented. If Canada decides to escalate the conflict, CAD assets will be under sufficiently strong pressure.

China remains the main target of Trump's election aggression, especially since Donnie is preparing for a debate with Biden. In turn, Biden argues that Trump will only threaten China, but will not dare to deal a serious blow. This is understandable − Trump hopes that the tariff hike will not have enough time to affect the growth rate of the US economy before the elections, and the super «positive» news about the vaccine should neutralize the fall in the US stock market just before the voting date.

The US and Chinese analysts will begin examining trade responses to the implementation of the Phase 1 trade agreement on Aug.15. It won't be difficult to blame China for failing to comply with the trade agreement: both sides acknowledge that China is far behind the US plans to buy products. Beijing will not have time to fulfil its obligations, and Trump does not need this: a political attack on China is more actively raising the rating.

A little more news − briefly:

- Trump supported the extension of extended unemployment benefits of $400 per week (previously it was $600), as well as exempting small businesses with income less than $100,000 a year from payroll taxes. The moratorium on the eviction of credit debtors and incentives for student loans were extended.

- Democrats have lost the battle over the basic parameters of a new fiscal stimulus package, although Trump is willing to act unilaterally. Trump also pledged to remove the payroll tax for low-income households if he wins the November elections.

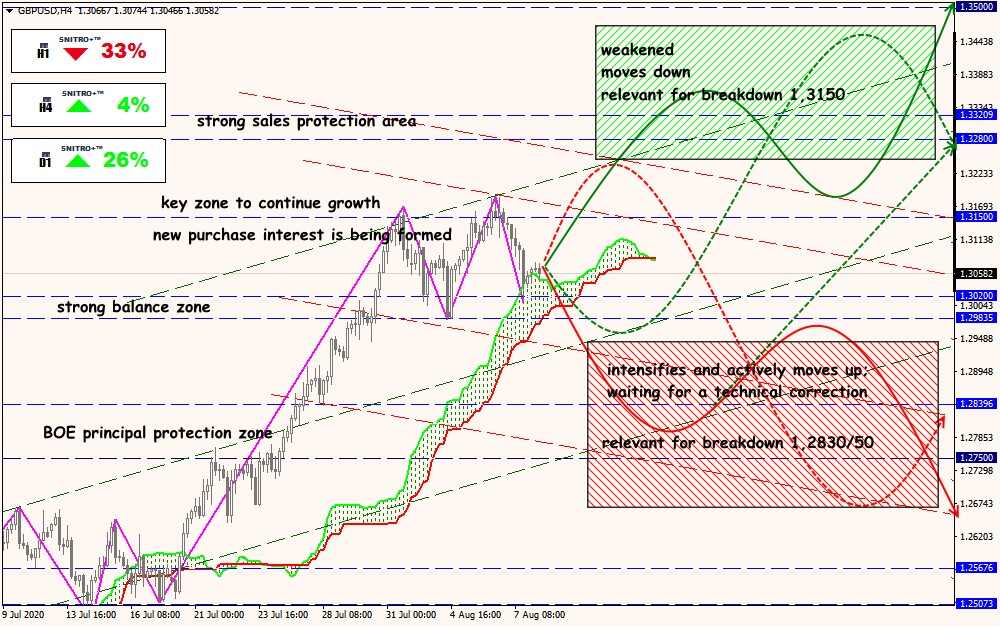

- BOE has left the policy unchanged, rates are in line with the current situation, the British central bank has room for additional incentives. Bailey stated that BOE does not consider negative rates to be effective in the current situation, and prefers to use traditional tools in the form of the QE program. In general, analysts regarded the rhetoric of the British regulator as “gloomy” and forecasts for a rate cut to -0.1% next year are not cancelled.

- The German payment operator Wirecard declared itself bankrupt in June (“hole” in the balance sheet − €2 billion). Banks, officials, politicians and auditing companies are gradually drawn into the scandal. The combined loss of Commerzbank, ING and Credit Agricole from the Wirecard disaster was €460 million; potential losses of Barclays, DZ Bank and Lloyds are estimated at €110 million. Comments on this topic may lead to short-term speculation on EUR/USD.

- Falling oil inventories continue to delight buyers, and the falling number of active oil rigs supports this optimism. Nevertheless, the threat to the global economic recovery leads to the need to hedge the downward risks, so this week you should be careful with the purchase of the main benchmarks.

The publication of the minutes of the July Fed meeting is scheduled for next week, as well as a new round of UK-EU talks. For now, pay attention to the statistics:

- USA − retail sales, consumer price inflation, job vacancies JOLTs, weekly jobless claims;

- Eurozone − German ZEW Index, Sentix Investor Confidence Index, Eurozone Trade Balance and GDP for Q2;

- Great Britain − report on the labour market, GDP of Britain for the 2nd quarter;

- China − inflation report, house price indices, unemployment rate and other data (in a comprehensive report), as well as a press conference by the National Bureau of Statistics of China.

No important speeches of financial figures are expected.

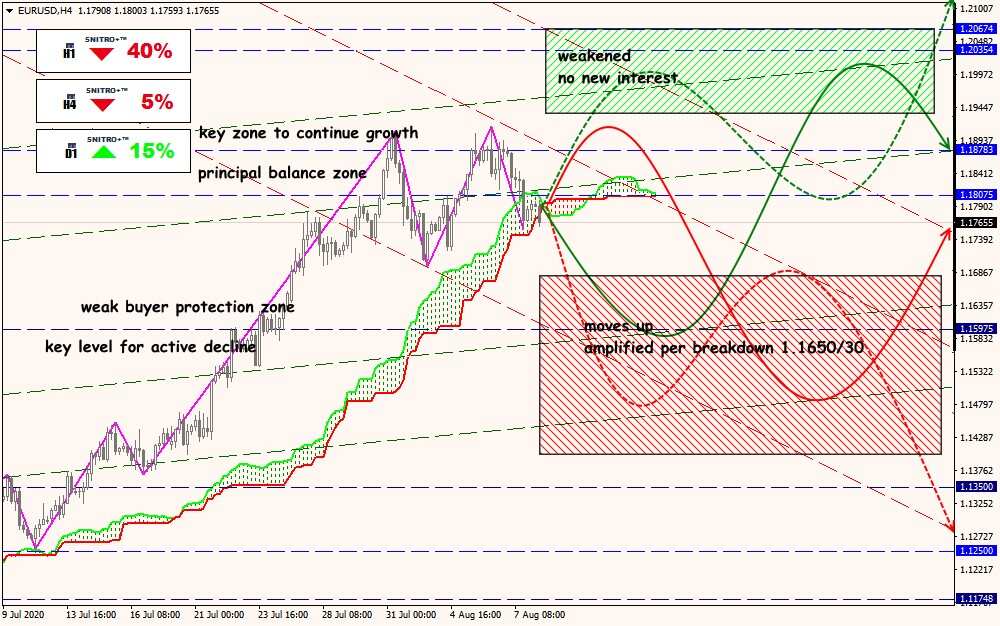

Technical Analysis EUR/USD

Technical Analysis GBP/USD

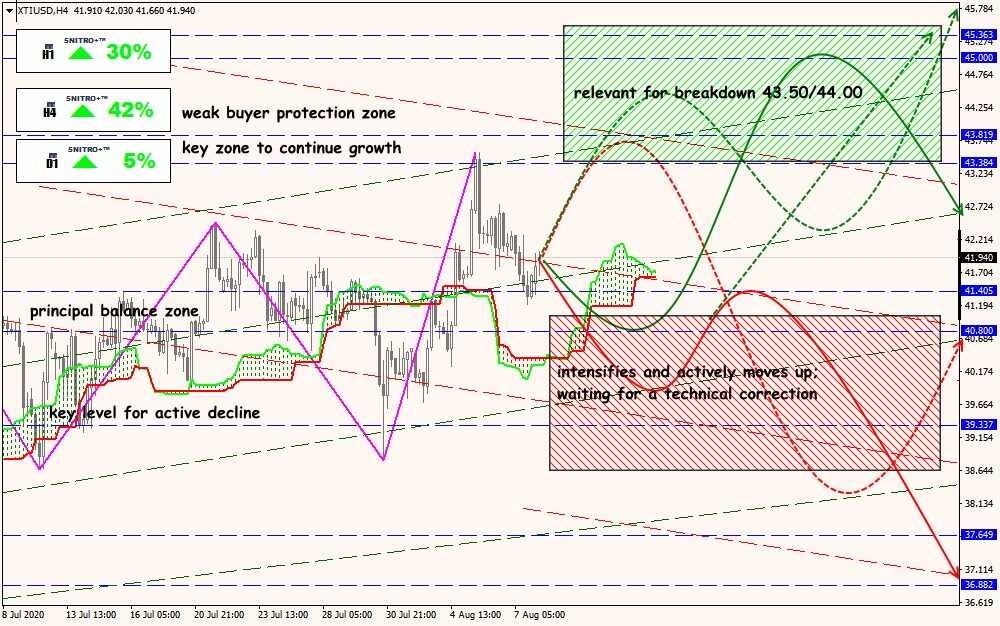

Technical Analysis XTI/USD